Good morning and welcome to Insider Finance. I’m Dan DeFrancesco, and here’s what’s on the agenda today:

- Robinhood CEO Vlad Tenev gave Elon Musk his take on last week’s drama, and the startup raised a fresh $2.4 billion to ride out the retail-trading insanity

- UK neobank Starling Bank could be set for a unicorn valuation with a fresh funding round led by Fidelity

- Knotel, the flex-space firm that once wanted to overtake WeWork, has filed for Chapter 11 bankruptcy

Sign up here for a webinar on the red-hot IPO market on February 3 at 2:30 pm ET with chief finance correspondent Dakin Campbell. Speakers include Goldman Sachs’ Kim Posnett, Latham & Watkins LLP attorney Greg Rodgers, and Lead Edge Capital’s Mitchell Green.

Like the newsletter? Hate the newsletter? Feel free to drop me a line at [email protected] or on Twitter @DanDeFrancesco.

Robinhood makes hundreds of millions from selling customer orders. That business model is about to come into focus.

Noam Galai/Getty Images for TechCrunch

A major portion of Robinhood’s business model that relies on handling a high volume of trading is once again getting attention, and it comes at a critical junction for the fintech, which had reportedly been hoping to go public as soon as this quarter.

Challenger Starling Bank is set to raise $274 million at a $1.5 billion valuation from major asset manager Fidelity

Starling Bank

Starling Bank could be set for a unicorn valuation with a fresh funding round. Fidelity has been eyeing Starling for a number of years with a view to investing.

Former Uber exec Ryan Graves just invested $50 million in Metromile

Ryan Graves, the billionaire former Uber exec who was the ride-hailing app's first hire, just announced his largest private investment since he left the company in 2019, and it's a bet on the future of auto insurance.

Graves is committing $50 million into Metromile, a pay-per-mile auto-insurance provider. He's joining the likes of Mark Cuban and Chamath Palihapitiya, who have together poured $160 million in private investments into the company as it prepares to go public in a $1.3 billion SPAC deal with NSU Acquisition Corp. II.

Former flexspace unicorn Knotel is filing for Chapter 11 bankruptcy ahead of a proposed sale to an investor. Leaked numbers show how its financials worsened in 2020.

Misha Friedman/Bloomberg/Getty Images

Knotel, once one of the brightest names in the flex-space industry and a self-proclaimed WeWork rival, has filed for bankruptcy and plans to sell its business to the publicly-traded real-estate services company Newmark.

You can see Knotel's leaked financials here.

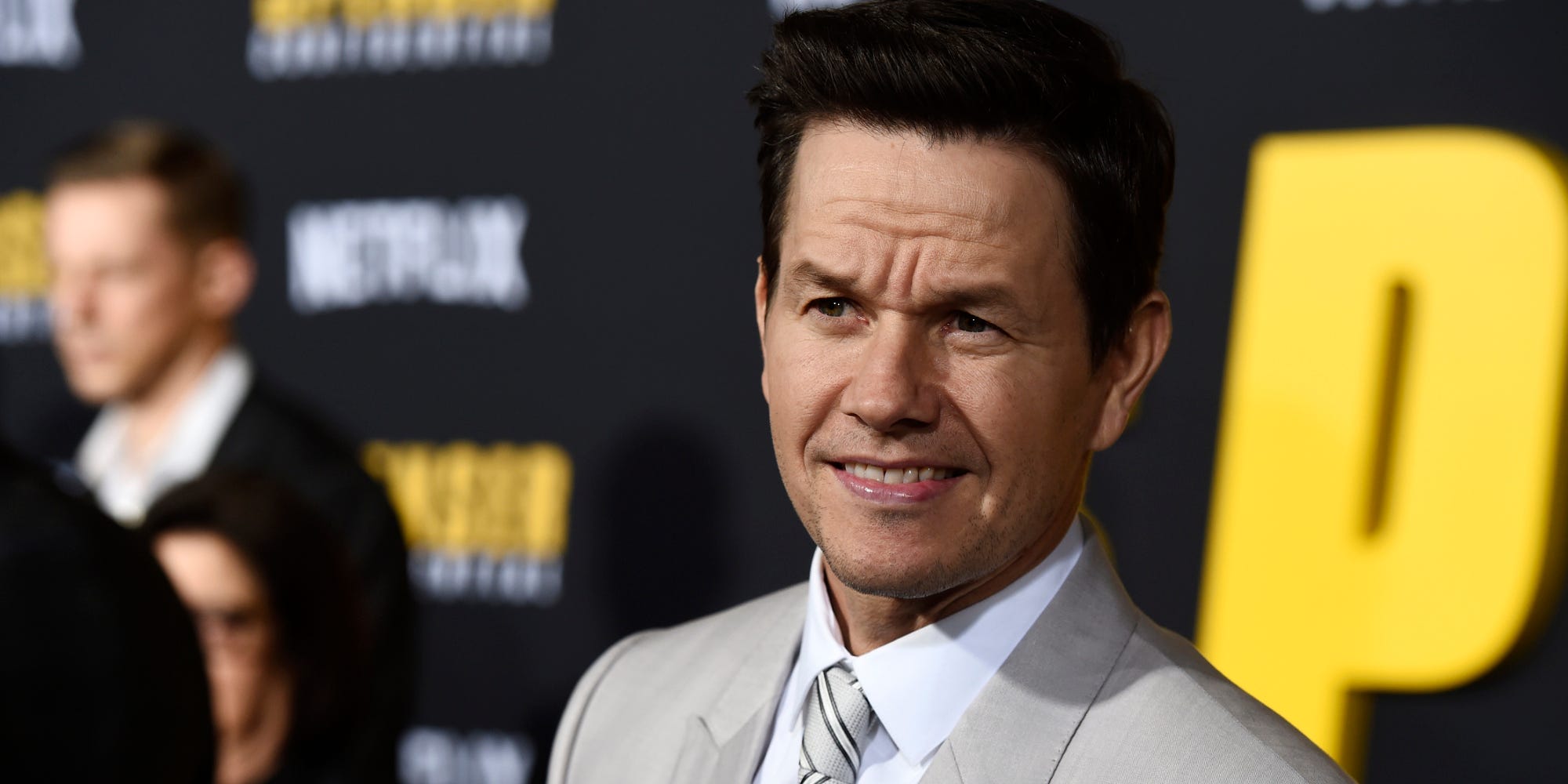

Check out the pitch deck startup Raydiant, which aspires to be the Square of in-store tech, used to raise $13 million from investors including Mark Wahlberg

Mark Wahlberg, the movie star and owner of burger chain Wahlburgers, wanted to be able to talk to all the employees and customers at his restaurants at once - to "go live" from one of the chain's locations and communicate with everyone in the store at once.

Now he's an investor in an internet-of-things startup's latest fundraising round. See Raydiant's full pitch deck here.

Odd lots:

What's coming next for COVID-19 vaccines? Here's the latest on 11 leading programs. (Insider)

Goldman Tightens Golden Handcuffs for a Booming Trading Desk (Bloomberg)